Allocate costs like transportation and import duties to inventories

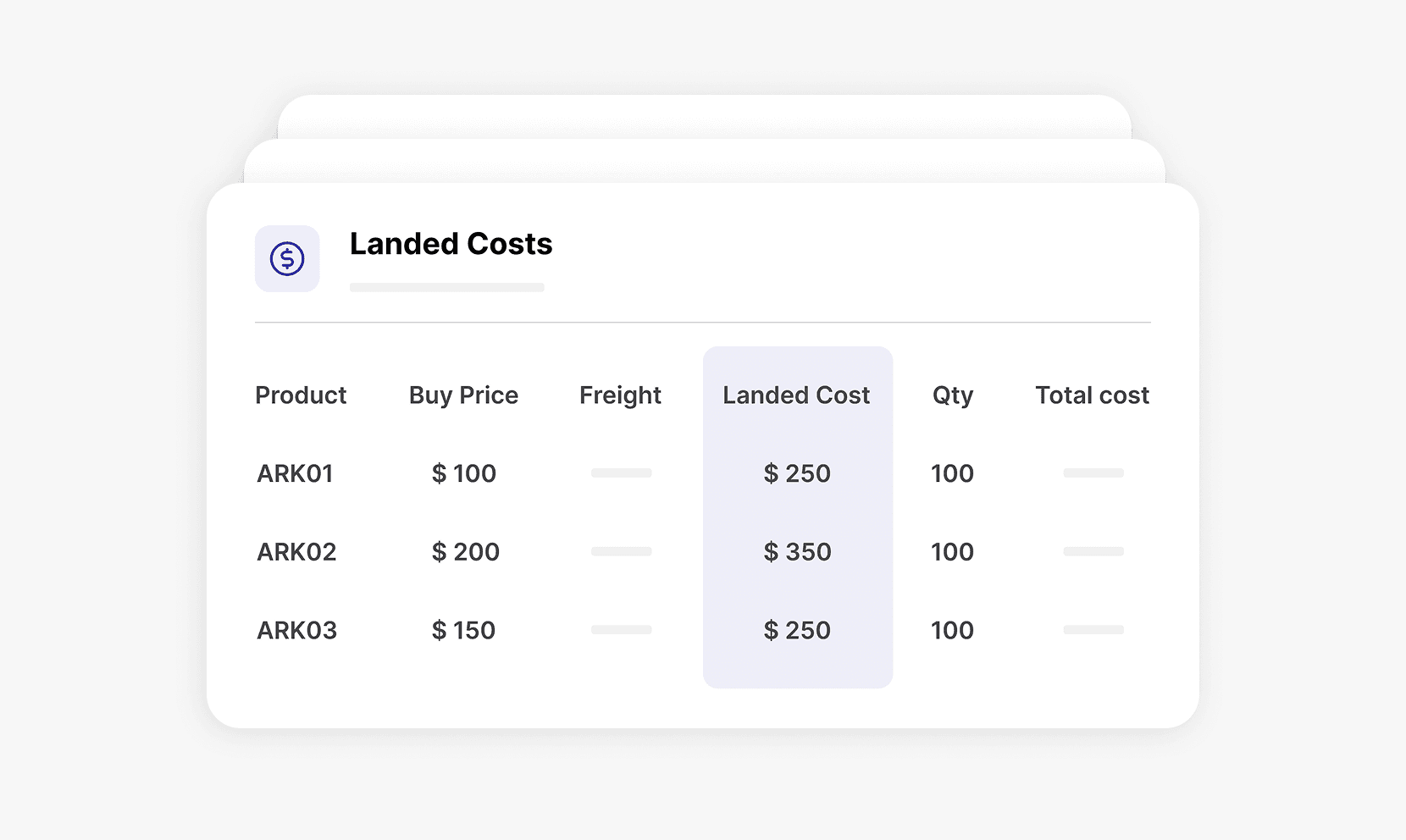

Calculate the true cost of inventory by including shipping, duties, taxes, and fees, enabling accurate pricing, better margin visibility, and informed purchasing decisions with Arka.

When purchasing goods, businesses need to consider various costs beyond the purchase price of the goods themselves, such as transportation fees, import duties, taxes, customs fees, and other expenses. Arka’s inventory management system calculates the total cost of a product, including these additional expenses.

Properly managing inventory costs requires businesses to allocate these costs to the appropriate inventory items and reflect the same in their accounting books.

With Arka’s landed cost feature, businesses can calculate the landed cost for each item, giving them a more accurate picture of the true cost of their inventory. This information can help them make more informed pricing and inventory management decisions.

Arka ensures that each unit is accounted for at its true landed cost, rather than just the purchase price. This can help businesses better understand their profit margins, set prices that cover all costs, and make smarter purchasing and inventory management decisions.